Over time, industries become more efficient. The industrial revolution represented a surge in this efficiency via the transition from human manufacturing to machinery, and industries continue to advance evermore. This increase in productivity should result in lower prices to the consumer.

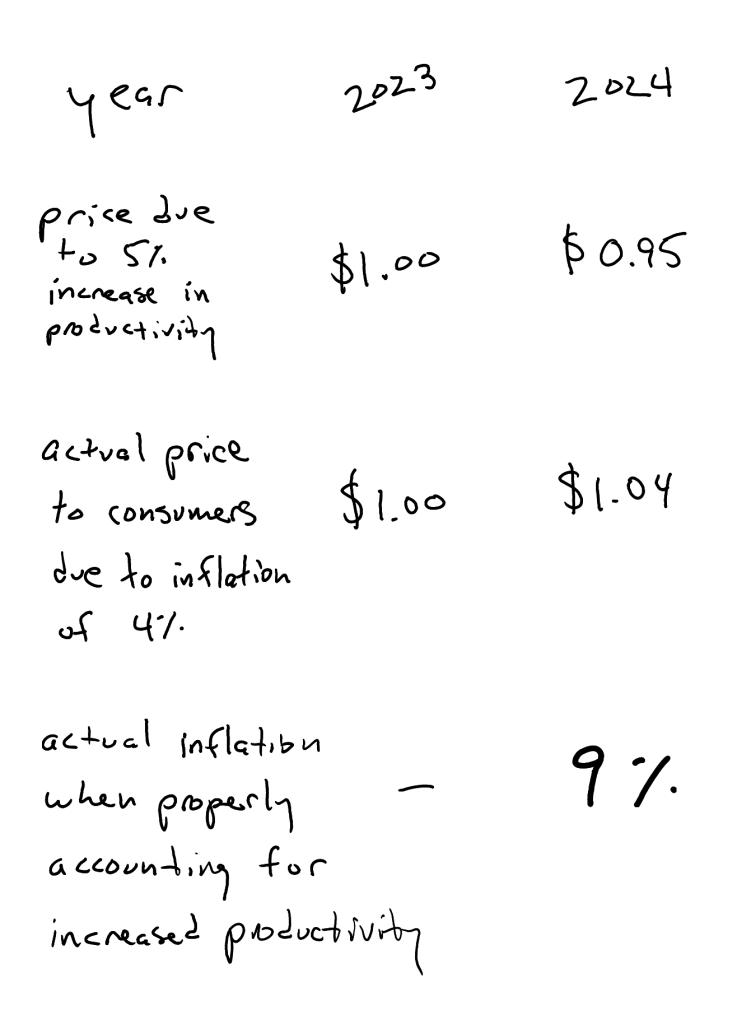

If the industrial efficiency of a product improves by 5% per year, this should result in a price decrease of 5% per year, given free market competition. If yearly price inflation was measured at 4% (as is done by the Bureau of Labor Statistics), and you account for the 5% price reduction from the increased productivity, the total inflation actually becomes 9% per year. We can call this 5% difference ‘subtle inflation’, and it is equal to the productivity increase of the product(s) at hand.

Subtle inflation is a hidden force that is invisible due to the fact that we have never experienced its absence. It uncovers a hidden source of the quite visible hardship on the populace, ingrained in the money we use. It shows yet another way that changing the fundamental money system would bring more prosperity to all. Gold, silver, and cryptocurrency all provide a medium of exchange while keeping a finite supply. So, they are resistant to all inflation, including subtle inflation. The advent of cryptocurrency is quite timely with spiraling inflation of even major fiat currencies, as a blessing and necessary invention.

This relationship between increased productivity and inflation is akin to ‘inflation taxes’ discovered by Daniel Amerman, As he explains, inflation causes asset prices to rise nominally, but not in actual value. Capital gains taxes are paid on this rise, so that real taxes are paid on imaginary gains.

In this hereby discovered parallel, money creation (monetary inflation) must be great enough to not only cause the increase in product prices (price inflation) that we see, but also match the natural decrease in prices of goods and services that occurs due to increased productivity.

art by Steve Kuzma

Edited October 25, 2023

Leave a Reply